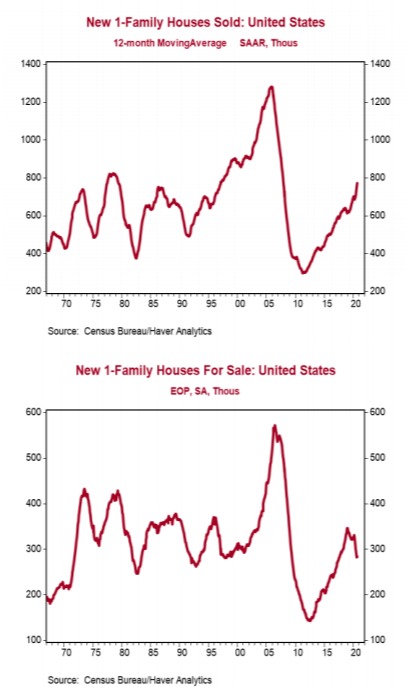

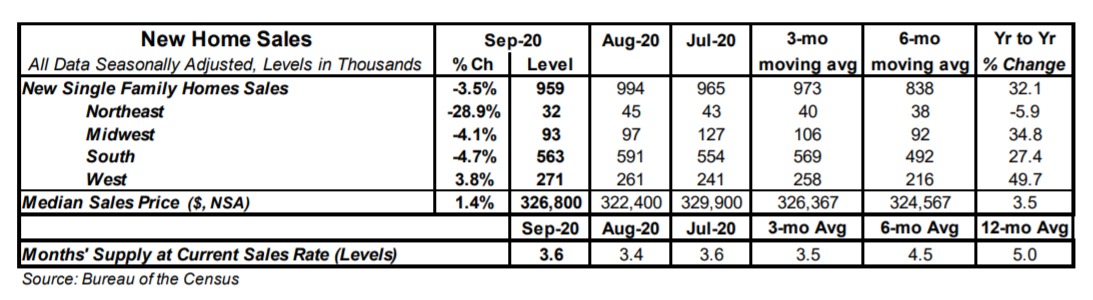

- New single-family home sales declined 3.5% in September to a 0.959 million annual rate, lagging the consensus expected 1.025 million. Sales are up 32.1% from a year ago.

- Sales fell in the Northeast, South, and Midwest, but rose in the West.

- The months’ supply of new homes (how long it would take to sell all the homes in inventory) rose to 3.6 months in September from 3.4 months in August. The increase was due to both the slower pace of sales and an increase in inventories of 2,000 units.

- The median price of new homes sold was $326,800 in September, up 3.5% from a year ago. The average price of new homes sold was $405,400, up 8.9% versus last year.

Implications: Following four consecutive months of substantial gains, new home sales took a breather in September. Despite the headline decline of 3.5% in today’s report, new home sales are still 23.9% above the January pre-pandemic high, and a couple of factors should continue to keep the recovery in new homes going in the months ahead. First, affordability; near zero interest rates from the Federal Reserve have helped reduce 30- year fixed mortgage to record lows. Second, due to the pandemic and urban unrest, buyers’ preferences have shifted away from units in denser urban environments, toward more spacious options in the suburbs, where most new single-family homes are built. Finally, there is still pent up demand from potential buyers whose purchases were temporarily disrupted by lockdowns and widespread economic uncertainty in the wake of the pandemic. However, a lack of finished new homes waiting for buyers is a likely headwind for sales going forward. In the past year, the only portion of the inventory of unsold new homes that has increased are homes where construction has yet to start. Meanwhile, the inventory of unsold homes that are either under construction or finished is down from a year ago. Given the downward pressure that social distancing regulations, shortages of labor, and supply chain issues continue to exert on new construction, we do not expect an oversupply of homes anytime soon. This is reflected in the months’ supply (how long it would take to sell today’s inventory at the current sales pace) of new homes for sale, which has collapsed from 6.8 in April during the height of the pandemic to only 3.6 in September, just above the lowest level on record going back to 1963. New home sales normally run around 70% of single-family housing starts, but have now exceeded that threshold for each of the past six months, sitting at 86.6% in September, and signaling plenty of appetite for new homes. And this has occurred despite single family housing starts rising in September to the fastest pace since 2007. In other words, even though new home construction has accelerated rapidly during the pandemic, it still needs to pick up more to keep pace with consumers’ appetites for new homes.

Click here to download a PDF of this report.

This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.