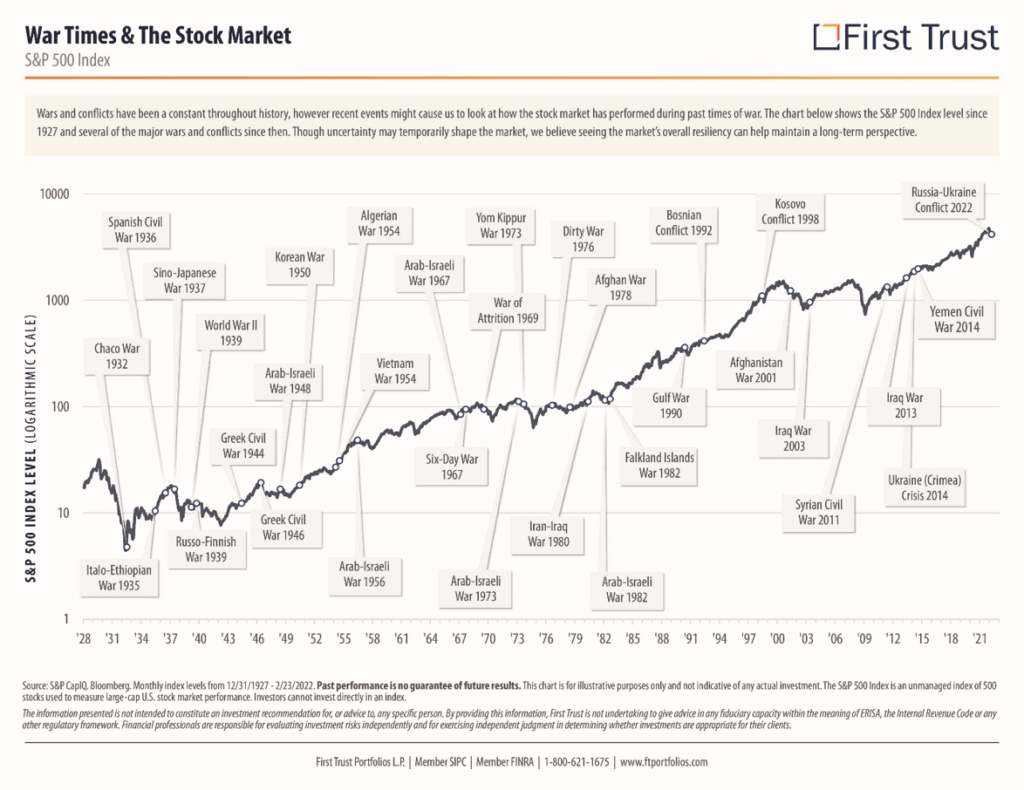

As tensions rise globally, particularly with renewed fears of a potential conflict involving Iran, investors may feel a sense of déjà vu. History, however, offers a reassuring perspective. At the start of the Ukraine War, we sent out this chart to offer some perspective. The chart below, originally published by First Trust Portfolios, illustrates how the S&P 500 Index has performed during major global conflicts since 1927.

While the last 3 years are not present, there is a very well-established trend. Despite the uncertainty that accompanies war, the long-term trajectory of the market has remained resilient. From World War II to the Gulf War, and more recently the Russia-Ukraine conflict, the S&P 500 has consistently demonstrated its ability to recover and grow over time. We believe this historical context still applies today. While short-term volatility is inevitable and no outcome is guaranteed, the broader trend underscores the importance of maintaining a long-term investment perspective. As always, feel free to reach out to us.